How To Ditch 10 Expenses For Travel Savings

Saving money to go travelling sometimes seems impossible as there’s always something that just annoyingly crops up, which means you have to dip back into those savings and start again. It’s especially difficult when you’re saving to go on a year long travel journey and it just seems like an unachievable goal to reach your final savings target so I wanted to share 10 simple things we sacrificed to give us a good starting point…

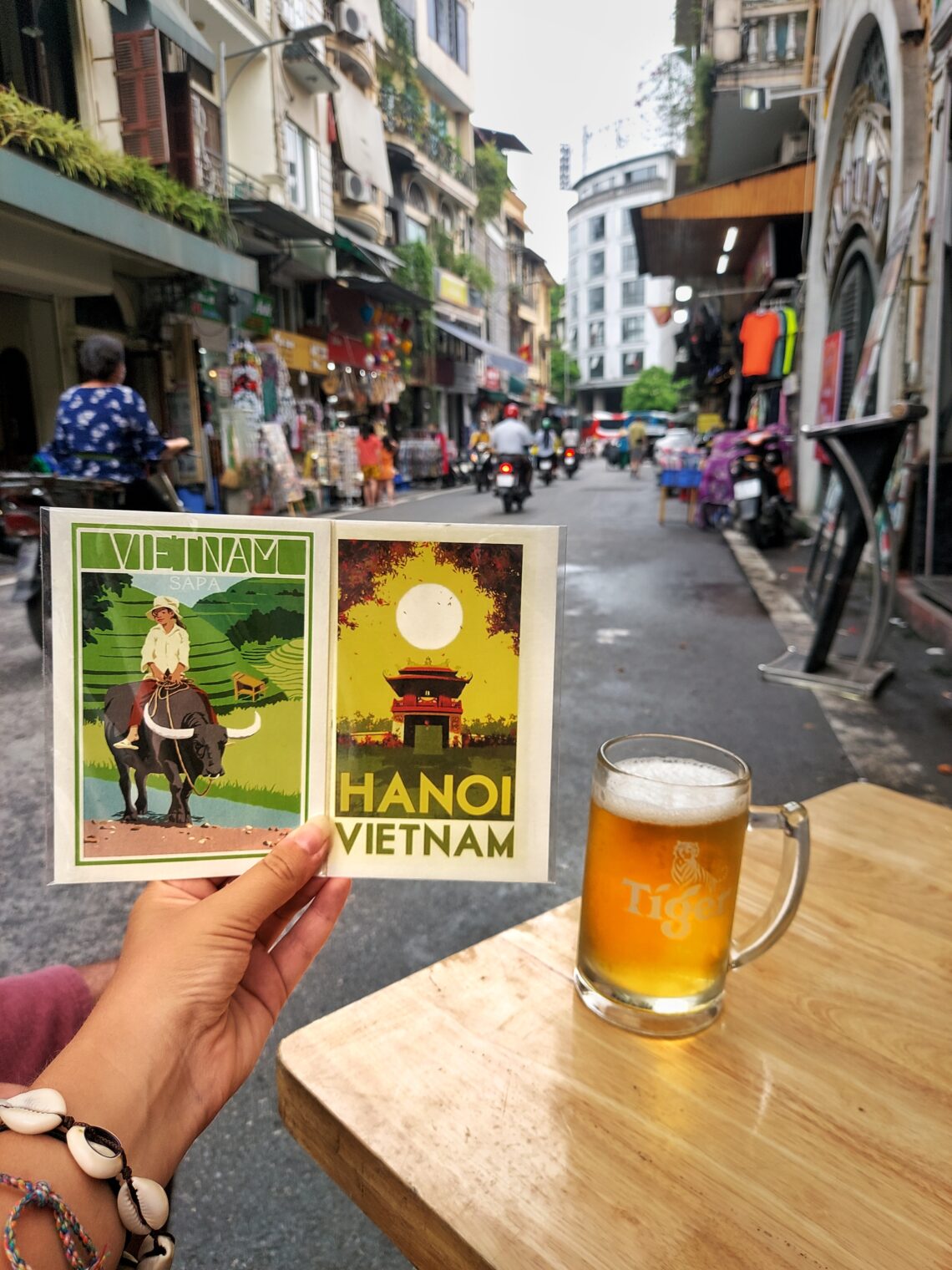

Going Out

We all know that we go out with the intention of ‘only a few’ but it never truly ends like that… just admit it, another drink won’t hurt. Actually, it will! In more ways than just the hangover, as in the long run this will hurt your purse.

Its so easy to spend around £100 on a night out, and whilst that might not seem like a lot, it all adds up! If you’re going out even twice a month in 1 year, that’s a saving of £2,400 which to me is a huge amount for such a small sacrifice. T and I don’t go on a night out often, mostly because we’re literally always working lol, but we do like a day out in London so it’s something we cut back on.

Eating Out & Takeaways

This is such an obvious one but so hard to stick too especially when you’ve had a long week at work and you could really do with a Domino’s and a bottle of wine, or a nice meal out at your favourite restaurant. We do like Giggling Squid I won’t lie. But, I promise you, and you will thank yourself, takeaways and meals out need to stop and the end result will be worth it.

The average UK consumer spends £451 per person every year on Takeaway food, with a typical customer ordering 34 takeaways over the course of 12 months, spending between £10-£15 per person on each meal.

Gym Memberships

Simple. If you’re not going every week at least 3 times a week, CANCEL the damn membership. What with free workouts online and no takeaways you’ll have your summer body in no time anyway without the daylight robbery gym membership.

Brand Names

Switching to doing our food shop at Aldi was the best move T and I have made. Big up Aldi. We would probably spend double on our food shop just because we went to Tesco and to be perfectly honest there is little to no difference between the products other than the label. This expense is definitely one of the smaller ones but you’ll notice the difference now that you’re making conscious decisions.

Weekend Getaways

When saving for a year of travelling you of course expect to not have holidays as you eventually will be on a 1 year+ one instead. What seems more appealing is a small weekend getaway but trust me this will set you back! If T could go away every month he honestly would, so we too have had to reign it in and remind ourselves of our goals. In my experience, taking multiple shorter breaks often come out more expensive than one longer holiday. So chose wisely and save your pennies!

Stopping Subscriptions

How many monthly subscriptions are you currently paying for? I bet you could make do without at least 2 as I know we 100% could. It really comes down to you making the choice and weighing up what is important to you and what you’re willing to temporarily stop to save yourself £££.

New Mobile Phones

Keep the one your currently using. Unless you’ve smashed it to pieces and can’t use it, then you need to be more careful. Most phone contacts are 1-2 years and realistically you do not NEED a new upgrade so if you can keep your old one for another 2-3 years then absolutely do! Besides, when you’re travelling you won’t have anyone to be able to compare who has the new upgrade! It’s all about your camera/ laptop/ drone anyway!

Beauty Treatments

I’m quite lucky here as I’m definitely not high maintenance when it comes to looks, T will back me up on this. If I get out my PJs and brush my hair it’s a good day, but that’s ok as T prefers me ‘Au Natural’! But I definitely do like the occasional treat or pamper, but that’s what I try to keep it to, occasional!

For example, getting my nails done twice a month would cost me £50, which if I keep that up, over a year would be £600 when I can buy a few bottles of nail varnish for £10-£20 max. It’s £600 that I know I (& T ) would rather I put into my travel savings. The same goes for hair appointments and eyebrow/eyelash extensions. They’re luxuries but definitely not necessities in my books.

Desserts

This tip is especially for T & I as he definitely has a ‘sweet tooth’. Warm cookie dough with vanilla ice cream and caramel sauce breaks us every time. Actually to be honest it doesn’t matter what type of dessert, we’re not picky. Anyway, whilst it seems like such a small saving, we could go for dessert everyday if we had it our way, but that extra £5 could be added to our travel fund and be put towards trying a new traditional dessert in Europe, Asia, South America or Australia, just to name a few on our bucket list.

Birthday/ Christmas Gifts

Meaningful rather than expensive. Homemade and thoughtful wins every time, or so my mum tells me. Don’t waste your money on buying family shiny shit. Who knows they might be able to visit you when you’re travelling and you can treat them then with a memory or an experience that they’ll actually remember.

So however you chose to save , if you ditch all of these extra expenses or even just a few, I promise you will save money to add to that ever growing travel fund!

Title

Description